When you think of American car companies, it should be somewhat humbling that the list isn’t that long. Other than Ford, GM and now Tesla, there are very few, truly American car companies that can trace their ownership and heritage to Detroit or Fremont or the American Midwest. Of course, some iconic American brands like Chrysler, Jeep still exist but they are run by European corporate houses. This is why Tesla’s rise over the past decade is not an insignificant achievement. As most hardware industries continued to flee America, Elon and his team willed into existence what is now a manufacturing behemoth that will dominate multiple industries for years to come.

We think the EV led disruption in the auto market will carve out space for at least one more American car company. It is true that many EV upstarts have failed trying to get a foothold in the market. Companies like Fisker, Canoo and Faraday have failed due to a whole host of factors and they surely won’t be the last. But both Lucid and Rivian have continued to solider on as public companies with products that have impressed the broader market. Of these two companies, we think Rivian has the most potential to follow the path laid out by Tesla. Here’s why:

Cult Following & Cultural Impact

It is hard to quantify a brand’s cult following, but in a 2024 brand loyalty survey, Rivian scored the highest out of all car brands, and it wasn’t even that close. Rivian scored almost 10 percentage points more than the next car company on the list. These levels of brand loyalty are extraordinary for a new company in a new industry that is just starting to grow and build out its platform.

But its not just brand loyalty, the Rivian brand is unique. Rivian has carefully cultivated an outdoorsy, laidback yet sophisticated vibe that has distinguished it from its peers. It’s quirky innovations such as the gear tunnel have been adopted by other brands, signaling its popularity and success. The release of its R2, R3 and RX brands were large events that had a Tesla like look and feel to it.

Last but not the least, Rivian’s brand is obviously aided by the non-controversial and buttoned up image of its CEO RJ Scravinge, who is almost the polar opposite of the more mercurial Elon Musk. Given the rise in controversy around the Tesla brand, Rivian has now emerged as the number one EV alternative to Tesla. It hasn’t quite leveraged this market position just yet, which brings us to our next point.

Cheaper Models in the Product Pipeline

Rivian’s primary obstacle to mass market adoption has been the lack of more affordable models in its product lineup. But that is about to change. In 2024, Rivian introduced two new product prototypes, the Rivian R2, which is a smaller version of the Rivian R1S and the R3 whose design is a throwback to 1980s rally cars like the Audi Quattro and a larger but more palatable electric version of the Volkswagen Golf.

Both the vehicles are going to be built on Rivian’s new Mid Size Platform (MSP) with the R2 having a longer 115 inch wheelbase compared to the 110 inch wheelbase for the R3. The R2 is expected to start production in 2026 while the R3 is scheduled for 2027.

While both models are exciting, what is even more exciting is Rivian’s intention to sell these models at sub $50k price points. The R2’s starting price is expected to be $45k to $50k while the R3 is supposed to be even lower, pegged between $35k to $40k. Both these price ranges are in a different universe altogether compared to Rivian’s current R1S and R1T offerings which are around $80k or more. What’s more, the $7,500 tax credit remains in place, you could buy a Rivian R3 for under $30k!

Rivian Is Starting to Be Profitable

One of Elon Musk’s biggest challenges while scaling Tesla was his attempts to expand Tesla’s manufacturing and production from 1 to 5. He said as much in a 2017 interview with Fortune, where he described the difficulties of scaling up production for the Tesla Model 3:

Production hell is real. We’re in it right now

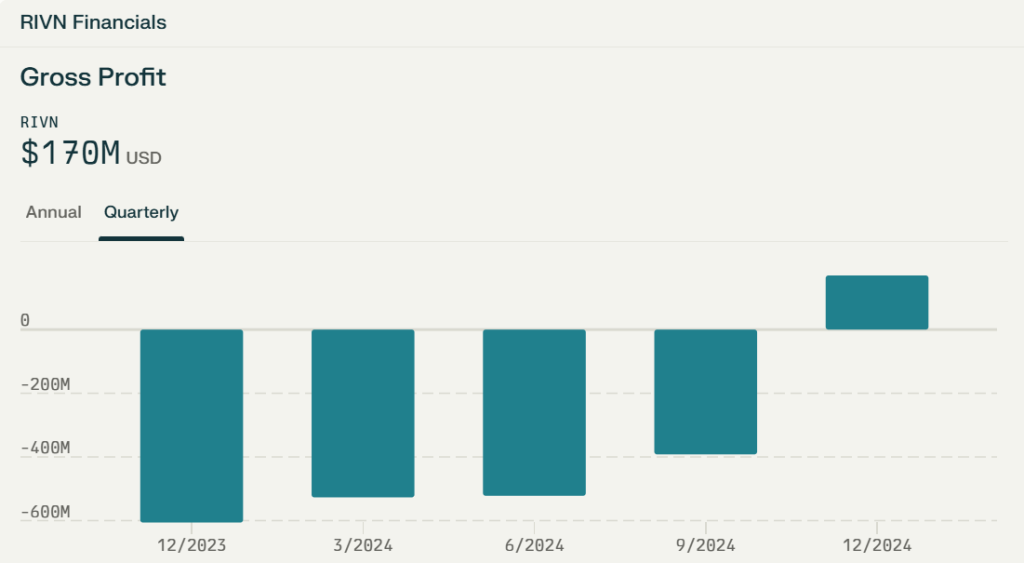

Building a cool prototype is the easy part, scaling it to hundreds of thousands of units profitably is the tough part. And that’s what Rivian’s challenge is. Its not just that, ever since its very popular IPO in 2021, Rivian has had to contend with several external headwinds that have challenged its attempts to scale production. From supply chain issues, to cost inflation to a wavering EV market, Rivian has had its work cut out for it. It finally had some good news recently as it finally reported a positive gross profit for every car it produced, which is a milestone for every car manufacturer. Now, for context, Tesla was able to report positive gross profit numbers at just half the production levels (almost half of Rivian’s 50k vehicles), but it was in a totally different market context and lets be honest, Tesla is an incredibly high bar to beat!

Being profitable on a gross profit basis is definitely nowhere close to actually being profitable, but it serves as a signal to investors that Rivian has the ability to rein in costs and improve margins as it scales. Remember, only two EV companies have positive gross margins today, Tesla and Rivian!

Strong Financial Backing

All of this leads us to our last point, which is Rivian’s strong position in the financial markets. For all its faults, Rivian still has a market cap in excess of $10 billion. This is no where close to Rivian’s >$100 billion market cap achieved in the aftermath of its IPO, but it still means that Rivian has no shortage of access to the capital markets to fund the cash burns that are typical of an auto manufacturer that is trying to quickly grow. It’s total cash burn for 2024 was $2.9 billion but it also has $7.7 billion in cash on its balance sheet and liquidity close to $9 billion. This is from Barrons:

Potter likes Rivian’s balance sheet strength, though. The company ended 2024 with about $7.7 billion in cash and $9.1 billion in total liquidity. That is enough cash to operate for about three years, according to Wall Street estimates.

Analysts believe that the company has a runway of three years. As the company scales one should expect the cash burn to be reduced as well. The game for Rivian is really just about surviving financially for the next few years. If it is able to survive and it continues releasing great products at a lower cost, it will continue to take market share from the rest of the market and establish itself as the next great American Car Company!