Rivian’s first Autonomy & AI Day probably felt like yet another company trying to piggyback off of the AI revolution and push its stock price up. After all, Rivian is still yet to scale production beyond the 50,000 per quarter mark and questions remain about its long term viability.

All those questions still remain but Rivian is right to see itself as not JUST another EV play that happens to ship software, but more as a company organized around software, data, and real-world intelligence, with vehicles serving as the delivery mechanism.

Rivian is increasingly betting that its in-house software and chip teams can add as much value as its vehicles themselves, possibly more, and that over time this matters more than even its carefully cultivated outdoorsy brand (and vibe).

Rivian’s stock has been doing surprisingly well

Rivian’s stock performance over the past year is easy to dismiss as noise, but it’s worth paying attention to the fact that the stock is up almost 40% YTD and investors are clearly responding to the idea that Rivian may be more than a capital-intensive EV OEM fighting for margin.

Rivian Automotive (RIVN) — Stock Price (Year to Date, as of Latest Close)

The re-rating is not about near-term deliveries or gross margin expansion. It’s about optionality and more specifically, the possibility that Rivian evolves into a company where software, data, and autonomy matter more to long-term value than unit vehicle economics.

Whether Rivian can execute on it is still an open question. But the market is no longer pricing the company as if trucks are the whole story.

Rivian is building autonomy in house, just like Tesla

There is no doubt that Tesla’s FSD systems and Waymo’s autonomous cars are a lot more advanced than Rivian. But that shouldn’t stop Rivian from investing and making a play for the autonomous market. In fact, there is increasing consensus developing in the markets that autonomy is going to be table stakes for all OEMs and certainly all EV OEMs.

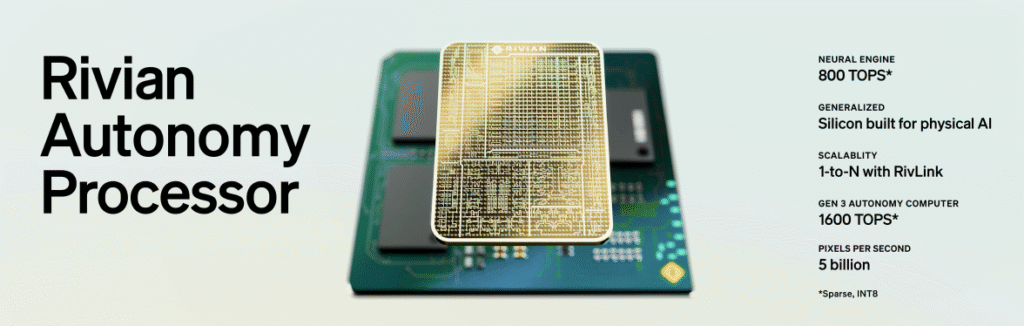

But the most consequential moment of the day was not hands-free driving. It was the announcement of Rivian’s own autonomy chip, the RAP1.

Designing your own silicon is not something automakers do lightly. It is expensive, slow, and unforgiving. You only take that step if you believe autonomy is central to your future and if you think relying on Nvidia forever puts a ceiling on what you can build. You also get to avoid the 70-80% margins that Nvidia typically charges for its chips.

Rivian is clearly borrowing from the Tesla playbook here. Tesla learned early that autonomy progress is gated by how tightly hardware and software evolve together. Rivian is now making the same bet, just a few years later and with the benefit of hindsight.

With its own in house chips, Rivian now controls its inference roadmap, its efficiency curve, and its ability to tailor compute to real world driving problems. That does not guarantee success, but it removes a structural constraint that has quietly limited most OEM autonomy programs.

On sensors, Rivian chooses pragmatism over perfectionism

The vision vs. radar/lidar debate (better known as the Tesla vs. Waymo debate) is one that has been going on for a long time.

While Tesla made a strong dogmatic bet on vision only Rivian is making a more pragmatic one by including LiDAR alongside cameras and radar. Rivian is using something called Early Sensor Fusion where the Rivian algo learns for itself when and how to weight camera, radar and LiDAR when necessary. This solves the problem of having a static, hand-written algorithm determine when and how to use each sensor.

There is no doubt that this approach will take time to scale as Rivian has only just begun to collect that data that is going to train its models. But the embedded optionality in this “all of the above” approach is bound to be both safe and successful over time and is also likely to find a lot of interest from other OEMs, not least of all, Rivian’s more established legacy OEM partner – Volkswagen.

Autonomy as a long term business

Rivian’s approach to autonomy should not be viewed only through the lens of Rivian’s own fleet. The more interesting upside is that Rivian now has a credible autonomy stack that could, in time, be deployed well beyond its branded vehicles.

Volkswagen’s $5.8 billion investment earlier this year takes on more significance in that context. VW does not need another electric pickup. It needs software. Specifically, it needs an autonomy and AI stack that can be standardized across millions of vehicles without being dependent on third-party suppliers. Rivian’s approach, if it proves robust, offers exactly that.

Even modest penetration across the VW Group fleet would dwarf what Rivian could ever achieve on its own. Selling autonomy software into Audi, Porsche, VW, or Skoda platforms would turn Autonomy+ from a per-vehicle upsell into a platform-level revenue stream. At that scale, attach rates matter more than branding, and learning velocity compounds much faster.

This is not guaranteed and it is not imminent. Integration, regulation, and internal politics all stand in the way. But strategically, this is where the real leverage sits. Rivian is not just building autonomy for its own trucks. It may be building it for one of the largest automotive fleets in the world.

The bigger bet: real-world AI and robotics

If you strip away the demos and the marketing gloss, what Rivian is really betting on is real-world AI. Not models trained in clean lab settings, but systems that learn from the chaos of actual streets, weather, people, and bad decisions. The kind of software that gets better by being used, not by having more rules written for it. Vehicles are the obvious place to start because they generate an absurd amount of data. That does not mean this has to stop with vehicles.

None of this is guaranteed to work. Autonomy has a long history of humbling teams with more money, more data, and more confidence than Rivian. Progress will be uneven. There will be stretches where it feels slower than promised and others where it jumps ahead unexpectedly. That is usually how real systems mature.

Everything hinges on whether Rivian’s stack actually ships in VW Group vehicles by 2026 or 2027. If it does, the investment case transforms entirely. This becomes a platform play with genuine recurring revenue leverage. If it doesn’t, Rivian has built an expensive autonomy program for a subscale truck manufacturer that still can’t turn a profit.

The autonomy announcement was Rivian telling the market how it sees its future. The question is whether VW, and ultimately other OEMs and customers, see it the same way. We’ll know within 18 months whether this was a strategic repositioning or just another expensive venture.