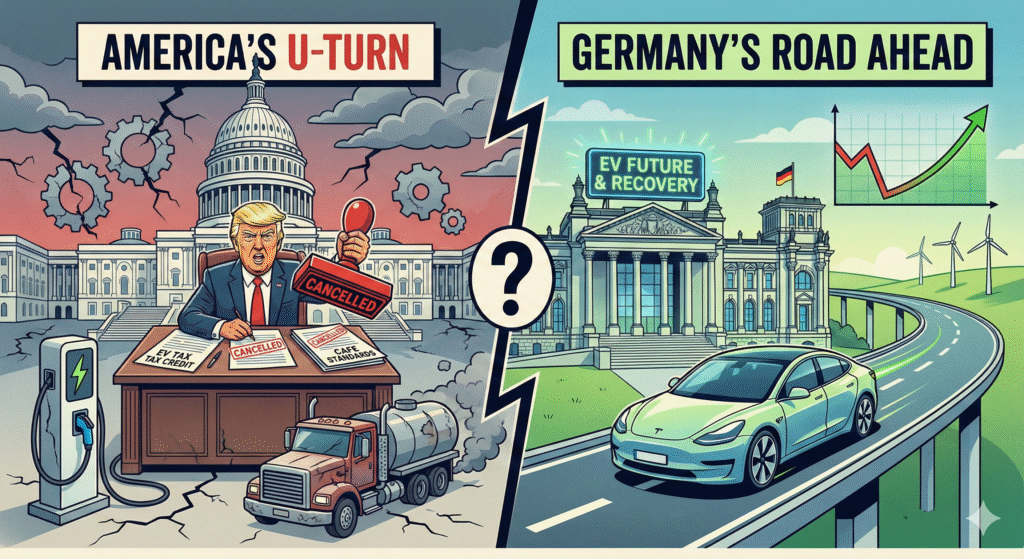

With Trump eliminating the $7,500 tax credit and gutting CAFE standards, it’s easy to think EVs are finished in America. But Germany just ran this exact experiment and what happened next might surprise you.

On December 3, 2025, President Trump eliminated fuel economy penalties and slashed 2031 CAFE targets from 50.4 mpg to 34.5 mpg. Combined with the earlier elimination of the $7,500 federal EV tax credit, it’s the steepest policy reversal any major auto market has ever seen.

So are EVs dead in America?

The short answer: No. But the next few years are going to be rough.

Here’s why I’m confident saying that: Germany just ran this exact experiment two years ago, and what happened tells us a lot about where America is headed.

Germany’s Crash and Recovery

In December 2023, Germany eliminated EV subsidies worth up to €6,000 with less than one week’s notice. The immediate aftermath was rough. In 2024, EV sales fell 27% to 381,000 units. Market share dropped from 18.4% to 13.5%. Tesla sales plummeted 41%.

But then came 2025. Sales rebounded 59% to roughly 605,000 vehicles, with market share recovering to 18.4%.

Here’s the catch: even with this strong recovery, Germany will only be about 5% ahead of where they were in 2022. They essentially lost three years of market development. But the key insight is they recovered without subsidies coming back.

How EV Markets Bounce Back Without Subsidies

The initial collapse happened because buyers always assumed that they needed subsidies to buy an EV. When subsidies disappeared overnight, fence-sitters bought traditional cars instead.

But recovery came as economics improved. EV prices dropped significantly adding to the cost savings on the fuel. Charging infrastructure expanded by 20,000 stations in six months. EVs could exist in the consumer’s consciousness without subsidies.

The fact that Germany recovered without subsidies returning suggests the technology and economics are reaching a tipping point where EVs can stand on their own.

Lessons From Other Markets

The UK ended subsidies in mid-2022 but maintained company car tax benefits and emissions trading schemes. The result was a modest slowdown, but sales kept growing.

China eliminated consumer subsidies at the end of 2022 after reaching 25% market share. The market just kept growing and is now above 50% penetration.

The pattern in the rest of the world suggests that policy removal in immature markets causes setbacks, but recovery is possible. The more mature the market, the smoother the transition.

America’s Position: Challenges and Advantages

The U.S. market sits at 8-9% EV penetration, which is more vulnerable than Germany’s 2023 EV penetration of 18% (prior to the removal subsidies). And Trump’s changes create a genuine double squeeze. The $7,500 federal tax credit is gone, making EVs more expensive for buyers. CAFE penalties are eliminated and standards slashed to 0.5% annual increases (down from 2%). This removes both consumer incentives and manufacturer pressure simultaneously.

But the U.S. has significant advantages Germany didn’t have. We have larger domestic scale and more established EV manufacturing. Tesla, Rivian, and the Detroit automakers have committed billions to U.S. production facilities. Those investments don’t just disappear because of policy changes.

Look at how manufacturers are actually responding. Yes, Ford paused F-150 Lightning production and Stellantis brought back Hemi V-8 engines. But Hyundai is staying fully committed to their EV strategy, and Kia is offering $10,000 discounts. These companies are making long-term bets that transcend any single administration’s policies.

Notably, very few are completely abandoning EVs, because they know the global market is moving electric regardless of U.S. policy.

What to Expect: A Realistic Timeline

Based on Germany and other international cases, here’s what seems likely.

In the near term (2026), expect a 20-30% decline in EV sales growth rates. This won’t be a collapse to zero, but it will be a noticeable slowdown. Germany lost €6,000 subsidies. We’re losing $7,500 tax credits while manufacturers simultaneously lose regulatory pressure.

In the medium term (2027-2028), a recovery begins to take shape with improving fundamentals. Battery costs keep falling every year. Infrastructure continues expanding through private investment. EVs continue approaching price parity with traditional vehicles and in certain cases becomes cheaper than gasoline or diesel.

Long-term (2029 and beyond) adoption really depends on a whole range of factors but it is hard to deny that electrification is inevitable. The global momentum toward electrification is so strong now that even hostile U.S. policy probably can’t stop the transition, just slow it down temporarily.

So, Are EVs Really Dead?

No. Not even close.

Germany’s experience shows removing subsidies hurts, that 27% decline in sales year over year was real. The U.S. faces this from a weaker position (8-9% penetration versus Germany’s 18%) with a more comprehensive policy reversal.

But Germany recovered without subsidies returning because EVs became competitive on their own merits. The U.S. is on that same trajectory, with fundamentals improving regardless of policy.

Global momentum is unstoppable. China is at 50%+ penetration. Europe is committed. Every major automaker has invested billions in electrification because that’s where the global market is going.

The most likely path: a rough couple of years, then recovery starting in 2028-2029. Not ideal, but far from a death sentence.

When someone asks “are EVs dead in America?” the answer is no. They’re taking a detour through challenging policy territory, but the destination hasn’t changed. The transition is happening globally, and America will be part of it even if we take a bumpier route to get there.