The new Trump administration recently came into power in the US throwing a potential wrench in everyone’s plans for increasing EV adoption. While there is a lot of concern and trepidation about the state of the EV market, there are several reasons to remain upbeat. We go through a few reasons why the next 4 years will continue to see the market for EVs progress –

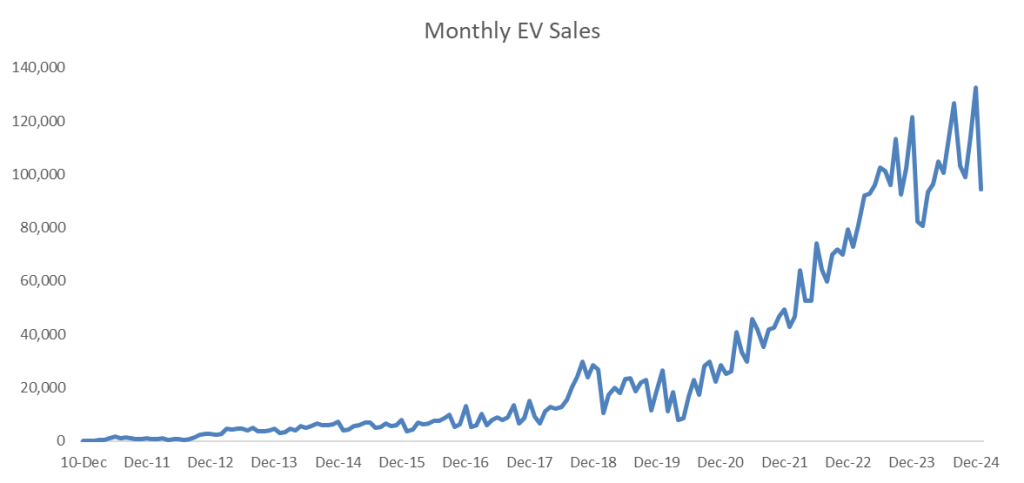

1. EV Sales Continue to Grow

We looked at the most recent January 2025 sales data for EVs published by the Argonne National Labs. EV sales increased almost 15% year over year in January, which isn’t that bad at all for a market that is supposedly in decline. Sure, it isn’t the 50%+ year over year growth we saw in 2022 and 2023, but it is still a growing market that is bound to keep both manufacturers and customers interested.

2. Cheaper EV Models

2025 is supposed to see several cheap EV models hit the market. The most anticipated of these is the more affordable Tesla model, probably a slimmed down version of the Model 3/Y, that is expected to be announced in the first half of 2025. Then you have the Kia EV3, the Hyundai Ioniq 3 all of which are expected to be in the ~$35,000 price level, or the $25,000 – $35,000 price range if they are eligible for some of the $7,500 federal tax credits.

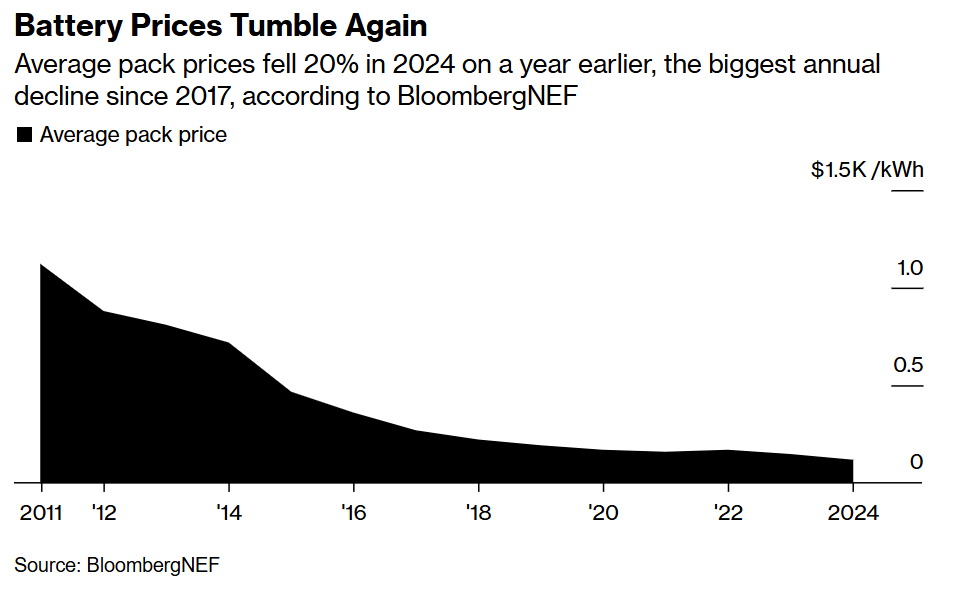

But more importantly, this is just going to be the start of a long term decline in EV prices. Battery prices fell about 20% in 2024 and are expected to decrease further as new battery factories get up and running and start churning out more and more batteries. Since batteries are the largest input cost for EVs, a decrease in battery prices will lead to a decline in EV prices.

3. Lower Interest Rates

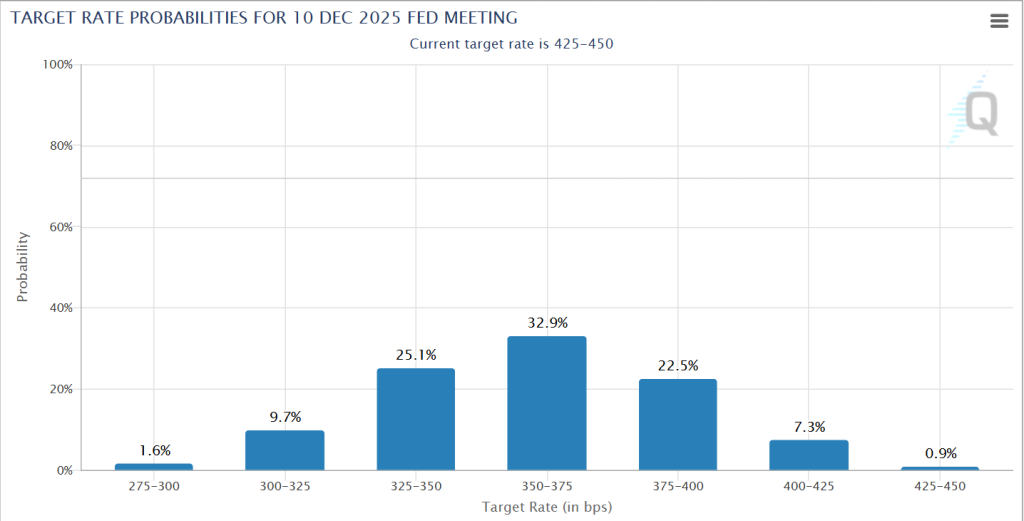

Almost 50% of all EV sales are actually lease deals which means that financing rates or interest rates are really important to lowering a customer’s monthly payment for an EV. Currently the market is projecting that the most likely outcome by year end is another .75% reduction in fed funds interest rates. What’s more, the 10 year treasury yield, which is a benchmark rate for lending has dropped by more than .40% since Trump’s inauguration and could continue decreasing if inflation keeps dropping.

If this is the start of a trend down for interest rates, EVs stand to disproportionately benefit because of its sensitivity to the leasing market and interest rates.

4. Advent of Autonomy

AI has been the buzzword over the past year and mobility is certainly going to start seeing a lot of disruption from AI over the next few years. Tesla’s Full Self Driving (FSD) has advanced in leaps and bounds and Elon has already indicated that the first robotaxis will be operational in Austin as early as June 2025. The advent of autonomy will only accelerate electrification as almost all autonomous cars will be electric because of the low latency of the electric motor. It is not just Tesla which is natively electric, Waymo’s fleet consists of the Jaguar I-PACE, and now potentially the Hyundai Ioniq 5 and the Chinese Zeekr, all of which are all-electric models.

An autonomous vehicle will always have to be electric because an autonomous internal combustion engine will not offer the fast response times, control precision and instantaneous feedback loop offered by an electric motor.