Buying a Tesla is a pretty expensive proposition, especially if you want to buy a more powerful model with a longer range. It’s easy to get lured in with prices that are “surprisingly” under $40,000, only to discover that it has limited range and power compared to what you’d hoped. For those looking for a more affordable way to buy a Tesla, for a way to spread the cost, you can always look for financing.

Tesla Financing – A Good Deal?

In today’s blog, we are exploring questions surrounding Tesla’s financing. First, we’ll be considering the kinds of credit score that you might need to even qualify for Tesla financing. After that, we’ll look in more depth at Tesla’s own finance deals compared with third-party providers to see who, in reality, is giving prospective Tesla owners the better deal.

What Credit Score Qualifies You for Tesla Financing?

Tesla’s car financing options begin at a rate of 2.49 percent APR for periods of 3 and 6 years (36 months and 72 months respectively, to use more regular car finance measures). They also offer leasing deals of 24 or 36 months on select models. Before you even get to the question of credit scores, you should actually begin by checking your own state laws, especially if you live in:

- New Mexico

- Alabama

- South Carolina

- Louisiana

- Texas

- Connecticut

- West Virginia

- Wisconsin

- Nebraska

- Oklahoma

What’s special about these states? These states carry total direct sales bans on car manufacturers. That means that manufacturers have to sell via independent dealerships, and can’t sell directly to the public via a directly employed sales force. That’s why in these states you see each dealership with their own website, name, style, etc. That’s why there’s so little uniformity or branding on dealership sites. Very often, when you’re looking at cars on the manufacturer website, you can build and request a quote on the model and specification you want, but that is then forwarded to a dealership. It’s not handled by the manufacturer directly. State franchising laws prohibit that.

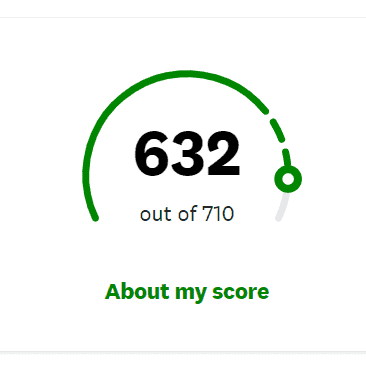

Anyway, assuming that you can get access to a direct deal from Tesla, what kind of credit score do you require? Tesla do not give a stated minimum credit score in order to apply or qualify for a Tesla auto loan. That doesn’t mean, however, that your credit score will have no impact on the deal you get. Tesla financing follows the same general rule as anywhere else: the better your credit score, the better the terms of your loan. In most cases, that means a lower rate of interest.

Along those lines, a score of “Good to Excellent” (720+) is what will get you those kinds of cheaper terms. That would mean an APR at or close to the above-mentioned minimum of 2.49 percent. You can also get financing on used Tesla stock, which starts for the high credit scores at 3.99 percent APR over a term of 72 months with a 10 percent down payment.

Which Tesla Models Can Be Bought with Financing?

For a new Tesla, whether or not you can get a certain finance arrangement depends on which model you’re hoping to buy. The list below explains which term lengths are available for which Tesla models:

- Tesla Model 3 – 48, 60 and 72 months available – no option for 36 months

- Tesla Model S – 36, 48, 60 and 72 months available

- Tesla Model X – Only 60 and 72 months available

- Tesla Model Y – 48, 60 and 72 months available – no option for 36 months

How do I start a Tesla Financing Application?

Tesla’s own Financing and Leasing page includes a handy calculator for you to work out in advance how much your financed Tesla will cost per month, as well as how much you’ll have to pay at signing. It works for both leasing and auto loan options.

It should be noted, however, that the calculator works at Tesla’s minimum APR rate of 2.49 percent. You should be aware that it could change depending on your actual credit score. The results of your using the finance calculator are by no means binding and are only meant as a guide.

Once you’re satisfied that the arrangement on those terms — or something close to it — would be acceptable, you can start the application process. To do that, you have to:

- First, if you haven’t got one already, you’ll need to make a Tesla account.

- Next, you’ll have to complete a loan application, which you can get from your Tesla account. Complete the form as fully and accurately as you can.

- Submit the application and await a response from a member of the Tesla finance team. Their website claims that someone will contact you within two days of submission.

Other Auto Loan Options

The restrictions above that we mention on auto loans only apply to those who are looking to get their financing done through Tesla’s in-house financing team. Regardless of whatever model or term package you’re looking for, you can still seek third-party financing from a bank or credit union.

The advantage of working with a bank is that you can get preapproval and thus know your exact budget before you begin car shopping. This helps you to narrow down your choices to better fit with your budget. It’ll remove the temptation to spend unnecessary funds on optional extras and upgrades because if you know it’s not an option, then it gives you that focus to resist the upselling sales patter.

The advantage of working with a credit union is that they generally offer better interest rates than banks, and can be more flexible with those who are currently in the “poor credit” zone.

Of course, while you have these options, none are quite as convenient as just being able to finance your new car with Tesla directly. Furthermore, Tesla has taken into account the reality of third-party competition and covered themselves using their “Best Rate Guarantee”

Tesla Financing – What is the Best Rate Guarantee?

Put simply, Tesla promises to match whatever rate you are given if you can prove that a third party has offered you better terms than Tesla. The scheme is valid for auto loans for the Model X, Model X, Model 3 and Model Y within the United States.

There are some terms and conditions, such as the scheme not applying to some particular specifications such as the Model 3 Standard Range. The interest rate quoted also has to match what you’re asking for at Tesla like for like, and Tesla will undoubtedly contact the third-party provide to verify that you were quoted that rate.

Tesla Leasing

Besides the auto loan, leasing is also an option for those looking to acquire a Tesla on finance. Prospective lessees should be aware, however, that getting a lease will further restrict your options on Tesla models.

Leases are only available for the Model S, Model X and Model 3 vehicles. Currently, there is no option to lease the Tesla Model Y. Furthermore, there are additional limitations on the purchase option at the end of your lease. For the Model X and Model S, you can opt to pay the residual value agreed on the lease and then own your Tesla outright. For the Model 3, this isn’t an option.

Conclusion: If Tesla Financing is Available, Go for It

The fact remains that buying a Tesla is not a cheap thing to do. Having every financial advantage available to you, therefore, is an important thing. If you are limited from Tesla’s in-house financing options, then you have other choices and can pursue them. In these cases, a bank, credit union or other third-party lender might be the best way to ensure the best possible terms and conditions. If Tesla financing is available to you, however, then thanks to their best rate guarantee, it’s very hard to deny that you will get both the best rate and the most convenience from sticking to in-house financing.

As with anything, it’s best to make use of the tools you have to determine in advance how much it is likely to cost you. Use the finance calculator on Tesla’s website, and work out some different payment scenarios to see just how much you can really afford. If you have a strong credit rating, then spreading the cost of your Tesla over a period of 36 to 72 months can be a great way to afford a higher-specification model with greater range and more premium features.